Stock Market Investing for Beginners: How to Get Started Building Wealth

Have you ever wondered how ordinary people build extraordinary wealth? The answer often lies in the stock market. Stock market investing has helped millions of people grow their money and achieve financial goals. While it may seem complicated at first, anyone can learn the basics and start investing with confidence.

Many beginners feel intimidated by charts, numbers, and financial terms. However, the core concepts are simpler than they appear. You don’t need a finance degree or millions of dollars to begin. In fact, many successful investors started with small amounts and basic knowledge. This comprehensive guide will teach you everything you need to know about stock market investing and how to take your first steps toward building wealth.

What Is the Stock Market?

Before diving into strategies, let’s understand what the stock market actually is. Simply put, it’s a place where people buy and sell ownership shares of companies. When you buy a stock, you own a tiny piece of that business.

The stock market connects buyers and sellers through exchanges. The New York Stock Exchange and NASDAQ are famous examples. These exchanges ensure fair transactions and set rules that everyone follows. Consequently, millions of trades happen safely every single day.

How Stocks Work

Companies sell stocks to raise money for growth and operations. In return, investors receive ownership shares and potential profits. If the company does well, stock prices typically rise. Therefore, investors can sell their shares for more than they paid.

Additionally, some companies share profits directly through dividends. These payments go to shareholders regularly, usually every three months. Stock market investing allows you to earn money through both rising prices and dividend payments.

Why Stock Prices Change

Stock prices move based on supply and demand. When more people want to buy, prices go up. When more people want to sell, prices go down. Many factors influence these buying and selling decisions.

Company performance affects stock prices significantly. Good earnings reports often push prices higher. Furthermore, economic conditions, industry trends, and world events all play roles. Understanding these factors helps investors make better decisions.

Benefits of Stock Market Investing

Why should you consider putting money in stocks? The advantages make stock market investing attractive for long-term wealth building.

Potential for Higher Returns

Historically, stocks have outperformed most other investment types. Over long periods, the stock market has averaged around seven to ten percent annual returns. This growth rate beats savings accounts, bonds, and many other options significantly.

Moreover, compound growth multiplies your money over time. When your investments earn returns, those returns also earn returns. Consequently, patient investors can build substantial wealth even from modest beginnings.

Beating Inflation

Inflation slowly reduces the value of money over time. A dollar today buys less than a dollar ten years ago. Savings accounts often pay interest below the inflation rate. Therefore, money in savings actually loses purchasing power gradually.

Stock market investing typically beats inflation over long periods. Your money grows faster than prices rise. This protection maintains and increases your real wealth throughout the years.

Ownership in Great Companies

Buying stocks makes you a part-owner of real businesses. You can own pieces of companies you admire and use daily. This ownership comes with voting rights and potential profit sharing.

Furthermore, successful companies benefit everyone involved. As businesses grow and prosper, shareholders benefit directly. Stock market investing connects your financial success to company success.

Getting Started with Stock Market Investing

Now let’s explore the practical steps to begin your investing journey. Starting is easier than most people think.

Assess Your Financial Situation First

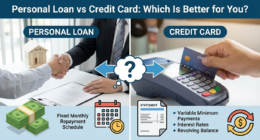

Before investing any money, examine your finances carefully. Pay off high-interest debt first, especially credit cards. These debts often charge fifteen percent or more annually. No investment reliably beats such high rates.

Additionally, build an emergency fund covering three to six months of expenses. This safety net prevents selling investments during emergencies. Stock market investing works best when you won’t need the money soon.

Set Clear Investment Goals

Why are you investing? Different goals require different approaches. Retirement thirty years away allows more risk than a house purchase in five years. Therefore, define your goals before choosing investments.

Consider your timeline carefully. Longer timeframes allow recovery from market downturns. Short-term goals need safer, more stable investments. Understanding your goals shapes your entire stock market investing strategy.

Choose a Brokerage Account

You need a brokerage account to buy and sell stocks. Many excellent options exist today with low or no fees. Online brokers make opening accounts quick and easy.

Furthermore, compare features before choosing a broker. Some offer better research tools. Others provide excellent mobile apps. Consider what matters most for your stock market investing needs.

Understanding Different Investment Options

The stock market offers various ways to invest. Each option has unique characteristics and fits different situations.

Individual Stocks

Buying individual stocks means selecting specific companies. You research businesses and decide which ones deserve your money. This approach requires more time and knowledge.

However, individual stocks offer control over your investments. You decide exactly where your money goes. Some investors enjoy researching companies and following their progress. Stock market investing through individual stocks suits people who want hands-on involvement.

Exchange-Traded Funds

Exchange-traded funds, called ETFs, hold many stocks in one package. When you buy an ETF, you instantly own pieces of dozens or hundreds of companies. This diversification reduces risk significantly.

Additionally, ETFs trade like regular stocks throughout the day. They typically charge lower fees than mutual funds. Many beginners start stock market investing with ETFs because they’re simple and effective.

Index Funds

Index funds track specific market indexes like the S&P 500. They aim to match market performance rather than beat it. This passive approach keeps costs very low.

Moreover, index funds provide instant diversification across many companies. They require minimal research or ongoing management. Many experts recommend index funds for beginner stock market investing.

Essential Stock Market Investing Strategies

Success requires more than just buying random stocks. Following proven strategies improves your chances of building wealth.

Start Early and Stay Consistent

Time is your greatest advantage in stock market investing. Starting early gives compound growth more years to work. Even small amounts grow substantially over decades.

Furthermore, consistency matters more than perfect timing. Invest regularly regardless of market conditions. This approach, called dollar-cost averaging, reduces the impact of price swings.

Diversify Your Investments

Never put all your money in one stock or sector. Diversification spreads risk across multiple investments. When some investments fall, others may rise and balance your portfolio.

Additionally, consider diversifying across asset types. Stocks, bonds, and real estate behave differently. A balanced portfolio weathers various economic conditions better. Smart stock market investing always includes proper diversification.

Think Long Term

Markets rise and fall constantly in the short term. Daily price movements mean little for long-term investors. Focusing on years and decades removes emotional stress from investing.

Moreover, trying to time the market rarely works well. Missing just a few of the best market days dramatically reduces returns. Stay invested through ups and downs for best results.

Common Mistakes to Avoid

Learning from others’ mistakes saves money and frustration. Avoid these common errors that hurt many new investors.

Emotional Decision Making

Fear and greed drive poor investment decisions. People often buy when prices are high and sell when prices are low. This behavior guarantees losing money over time.

Therefore, create a plan and stick with it. Don’t panic during market downturns. Don’t get greedy during market booms. Successful stock market investing requires emotional discipline above all else.

Ignoring Fees and Costs

Investment fees eat into returns over time. High fees can cost thousands of dollars over an investing lifetime. Even small percentage differences matter enormously.

Furthermore, compare expense ratios when choosing funds. Look for low-cost options that don’t sacrifice quality. Keeping costs low improves your stock market investing results significantly.

Trying to Get Rich Quickly

Some beginners chase hot stocks hoping for quick profits. This gambling approach rarely ends well. Most day traders lose money over time.

Instead, focus on steady long-term growth. Building wealth takes patience and discipline. Stock market investing rewards those who think in decades, not days.

Managing Risk in Your Portfolio

Every investment carries some risk. Smart investors manage risk rather than avoid it completely.

Understand Your Risk Tolerance

Risk tolerance describes how much loss you can handle emotionally and financially. Young investors with stable incomes can typically accept more risk. Those near retirement usually need more conservative approaches.

Additionally, be honest about your reactions to losses. Some people panic when portfolios drop significantly. Others remain calm during downturns. Your personality affects what stock market investing approach works best for you.

Rebalance Regularly

Over time, some investments grow faster than others. Your portfolio may drift away from your target allocation. Regular rebalancing restores your intended balance.

Furthermore, rebalancing forces selling high and buying low automatically. This discipline improves long-term returns. Review your portfolio at least once yearly and adjust as needed.

Taking Your First Steps Today

You now have the knowledge to begin your stock market investing journey. Start by opening a brokerage account this week. Fund it with whatever amount you can afford.

Consider beginning with a diversified index fund or ETF. These options provide instant diversification with minimal complexity. As you learn more, you can explore additional investments.

Remember that every expert was once a beginner. The most important step is simply starting. Your future self will thank you for beginning your stock market investing journey today.

References and Further Reading: