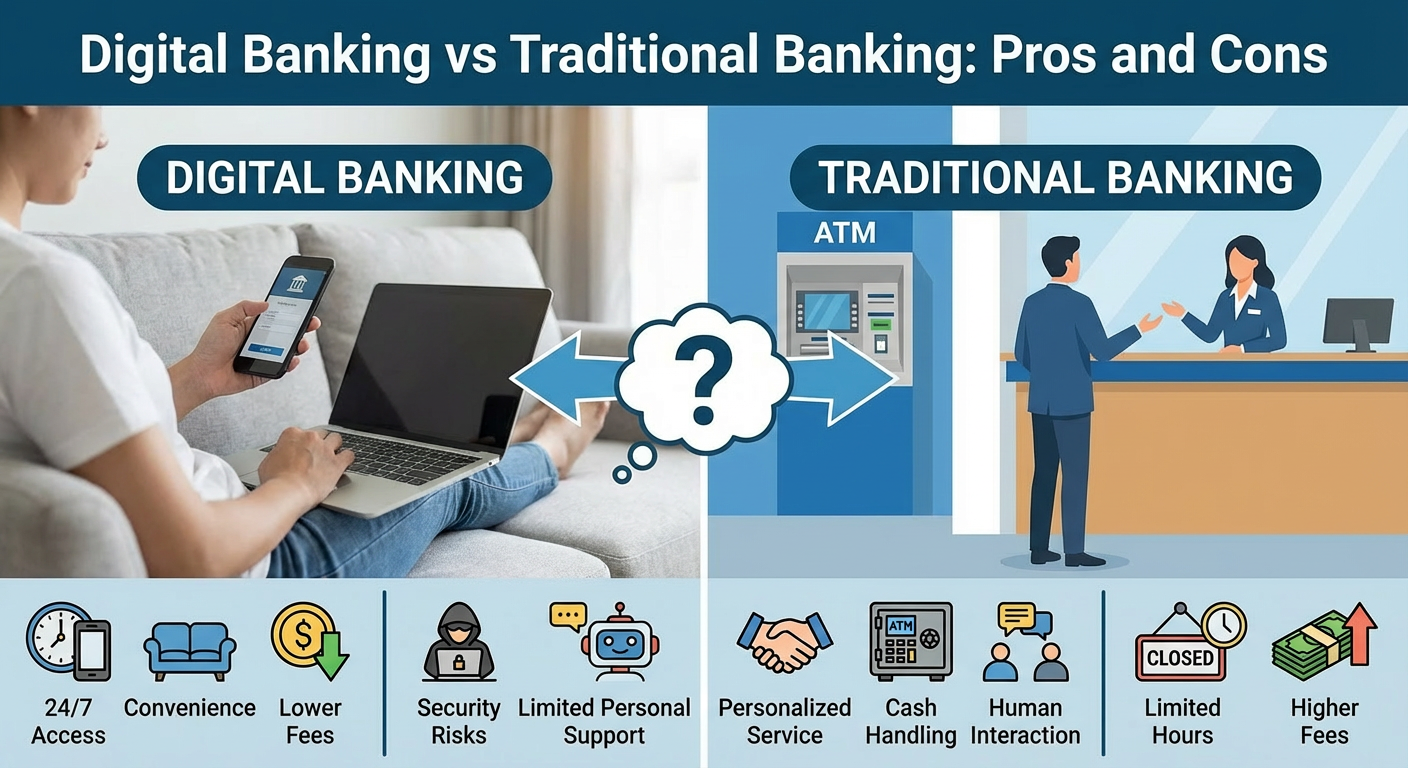

Digital Banking vs Traditional Banking: Pros and Cons

The way we manage money has changed dramatically over the years. Today, digital banking has become a popular choice for millions of people worldwide. However, traditional banking still holds its ground with loyal customers who prefer face-to-face interactions. So, which option is right for you?

In this complete guide, we will explore digital banking and traditional banking side by side. We will look at the advantages and disadvantages of each approach. By the end, you will have a clear understanding of which banking method suits your lifestyle and needs best.

What Is Digital Banking?

Before we dive into comparisons, let’s understand what digital banking actually means. Digital banking refers to banking services that you access through the internet or mobile apps. You can manage your money anytime and anywhere without visiting a physical branch.

Moreover, digital banking includes a wide range of services. These services cover account management, money transfers, bill payments, and loan applications. Everything happens online through your computer, tablet, or smartphone.

How Digital Banking Works

Digital banking operates through secure online platforms and mobile applications. When you open an account, you complete the process entirely online. Subsequently, you receive login credentials to access your account whenever you need.

Furthermore, digital banking uses advanced security measures to protect your money. These measures include encryption, two-factor authentication, and biometric verification. As a result, your financial information stays safe from unauthorized access.

What Is Traditional Banking?

Traditional banking is the conventional way of managing money through physical bank branches. You visit a local branch to open accounts, deposit money, or speak with bank representatives. This model has existed for centuries and remains popular today.

Additionally, traditional banks offer in-person customer service. You can sit down with a banker to discuss your financial needs and get personalized advice. Many people find comfort in this human connection.

How Traditional Banking Works

Traditional banking requires you to visit a branch during business hours. You fill out paper forms, show identification documents, and speak with bank staff. While this process takes more time, some customers prefer this hands-on approach.

Besides branch services, traditional banks also offer ATM networks and call centers. However, the core experience revolves around physical locations where customers can interact directly with employees.

Pros of Digital Banking

Now, let’s examine the benefits that digital banking offers to modern consumers.

Convenience and Accessibility

First and foremost, digital banking provides unmatched convenience. You can check your balance, transfer money, or pay bills at any time of day. There’s no need to wait in line or rush to the bank before closing time.

Additionally, digital banking works from anywhere with an internet connection. Whether you’re at home, at work, or traveling abroad, your bank is always within reach. This flexibility makes managing money incredibly easy.

Lower Fees and Better Rates

Digital banking often comes with lower fees than traditional options. Since online banks don’t maintain expensive branch networks, they pass savings to customers. Consequently, you might enjoy free checking accounts and reduced transaction fees.

Furthermore, many digital banks offer higher interest rates on savings accounts. Without the overhead costs of physical locations, these banks can provide better returns on your deposits. Over time, this difference can add up significantly.

Faster Transactions

Speed is another major advantage of digital banking. Money transfers happen almost instantly in most cases. You don’t need to wait for checks to clear or for manual processing to complete.

Moreover, digital banking allows you to set up automatic payments and transfers. This feature helps you never miss a bill payment again. Everything runs smoothly in the background while you focus on other things.

Advanced Financial Tools

Digital banking platforms often include helpful financial tools. These tools may include spending trackers, budget planners, and savings goals. As a result, you gain better control over your financial life.

Additionally, many digital banks send real-time notifications about your account activity. You know immediately when money enters or leaves your account. This transparency helps you stay on top of your finances.

Cons of Digital Banking

Despite its many benefits, digital banking has some drawbacks worth considering.

Limited Personal Interaction

One significant downside of digital banking is the lack of human contact. When you have complex questions or problems, talking to a real person can be difficult. Customer support often happens through chat, email, or phone calls.

Furthermore, building relationships with bankers becomes challenging online. In traditional settings, you might have a dedicated banker who knows your history. Digital banking rarely offers this personal touch.

Technology Dependence

Digital banking requires reliable internet access and working devices. If your internet goes down or your phone breaks, accessing your money becomes difficult. This dependence on technology can frustrate some users.

Additionally, not everyone feels comfortable using digital platforms. Older generations or those less familiar with technology may struggle with online banking. The learning curve can seem steep at first.

Security Concerns

While digital banking uses strong security measures, online threats still exist. Hackers constantly try to breach banking systems and steal customer information. Therefore, you must stay vigilant about protecting your login details.

Moreover, phishing scams target digital banking customers frequently. Criminals send fake emails or messages trying to steal your credentials. Being aware of these threats is essential for safe digital banking.

Limited Services

Some digital banks don’t offer the full range of services that traditional banks provide. For example, you might not be able to get a mortgage or business loan through an online-only bank. Complex financial needs may require traditional banking relationships.

Pros of Traditional Banking

Traditional banking offers its own set of advantages that appeal to many customers.

Face-to-Face Service

The most obvious benefit is personal, in-person service. You can walk into a branch and speak directly with a banker. This human interaction helps when dealing with complicated financial matters.

Additionally, traditional banks often assign relationship managers to valuable customers. These professionals understand your financial history and goals. They can provide tailored advice based on your specific situation.

Full Range of Services

Traditional banks typically offer comprehensive financial services under one roof. From checking accounts to mortgages to investment products, everything is available. This convenience appeals to customers who want all their banking in one place.

Furthermore, traditional banks often have established relationships with other financial institutions. These connections can help with large transactions, international transfers, or specialized lending needs.

Physical Access to Cash

Having nearby branches and ATMs matters for cash transactions. When you need to deposit physical cash or checks, traditional banks make this easy. You simply visit your local branch and complete the transaction.

Moreover, some businesses and individuals still prefer dealing in cash. For these situations, having a traditional banking relationship proves valuable.

Established Trust

Traditional banks have long histories and established reputations. Many have operated for decades or even centuries. This track record provides confidence and security for conservative customers.

Additionally, traditional banks are heavily regulated by government agencies. This oversight ensures they follow strict rules to protect customer money.

Cons of Traditional Banking

However, traditional banking comes with notable disadvantages as well.

Limited Hours and Accessibility

Traditional banks operate during set business hours, usually nine to five on weekdays. If you work during these times, visiting a branch becomes inconvenient. You may need to take time off just to handle banking tasks.

Furthermore, branch locations might not be convenient for everyone. If the nearest branch is far from your home or work, simple transactions become time-consuming.

Higher Fees

Traditional banks often charge more fees than their digital counterparts. Monthly maintenance fees, ATM fees, and transaction charges can add up quickly. These costs eat into your savings over time.

Additionally, traditional banks typically offer lower interest rates on deposits. The expense of maintaining branches and staff means less money available for customer returns.

Slower Processing Times

Many processes take longer at traditional banks. Opening an account, applying for loans, or transferring money often requires multiple steps. You may need to visit the branch several times to complete certain tasks.

Moreover, paperwork and manual processing slow things down further. What takes seconds online might take days through traditional channels.

Making the Right Choice for Your Needs

Choosing between digital banking and traditional banking depends on your personal preferences and lifestyle.

Consider Your Banking Habits

Think about how you typically handle your finances. Do you prefer doing everything on your phone? Then digital banking likely suits you well. Do you value face-to-face conversations about money? Traditional banking might be better.

Evaluate Your Technical Comfort

Your comfort level with technology matters significantly. If you easily navigate apps and websites, digital banking will feel natural. However, if technology frustrates you, traditional banking offers a familiar experience.

Assess Your Financial Needs

Consider what banking services you actually need. For basic checking and savings, digital banking works excellently. For complex needs like business accounts or large loans, traditional banks may serve you better.

The Future of Banking

Interestingly, the line between digital and traditional banking continues to blur. Many traditional banks now offer robust online and mobile services. Meanwhile, some digital banks are opening limited physical locations.

This hybrid approach gives customers more choices than ever before. You might use digital banking for daily tasks while maintaining a traditional account for specialized needs.

Conclusion

The debate between digital banking and traditional banking has no single winner. Both options offer unique advantages and disadvantages that appeal to different customers. Your ideal choice depends on your lifestyle, preferences, and financial needs.

Digital banking shines with convenience, lower fees, and advanced tools. Traditional banking excels in personal service, comprehensive offerings, and established trust. Many people find success using a combination of both approaches.

Take time to evaluate your priorities and test different options. With the right banking choice, managing your money becomes easier and more rewarding.

References:

For more insightful articles on finance and technology, visit Digital New IT.

For quick and easy link shortening solutions, check out URL Shorter.