How To Manage Your Money Like The 1%: Secrets of Wealthy People

Introduction: Learning To Manage Your Money Like Millionaires

Understanding how to manage your money effectively separates wealthy individuals from everyone else. Furthermore, the top 1% don’t necessarily earn more money initially, but they handle it differently. Generally speaking, learning to manage your money using proven strategies helps build lasting wealth over time. Moreover, these principles aren’t complicated secrets but rather disciplined habits anyone can adopt.

Additionally, wealthy people manage your money mindset before focusing on specific tactics. Subsequently, their approach combines smart saving, strategic investing, and intentional spending habits. Therefore, adopting these methods transforms your financial future regardless of current income level. Meanwhile, this comprehensive guide reveals exactly how the wealthy manage your money to build and preserve generational wealth.

Mindset Shifts To Manage Your Money Successfully

Thinking Long-Term About Wealth Building

First and foremost, wealthy individuals manage your money with decades-long perspectives rather than short-term thinking. Generally, they sacrifice immediate pleasures for future financial security and freedom. Furthermore, this delayed gratification mindset allows compound growth to work its magic over time. Consequently, patience becomes their greatest wealth-building tool.

Moreover, the 1% view money as a tool rather than a goal itself. Subsequently, they manage your money to create freedom, opportunities, and lasting legacy. Additionally, this perspective prevents emotional spending and impulsive financial decisions. Meanwhile, developing this mindset requires conscious effort and consistent practice daily.

Furthermore, wealthy people embrace calculated risks when they manage your money strategically. Therefore, they understand that avoiding all risk actually guarantees losing purchasing power to inflation. Moreover, educated risk-taking through diversified investments builds wealth faster than conservative savings alone.

Continuous Financial Education

Subsequently, the wealthy never stop learning how to manage your money more effectively. Generally speaking, they read books, attend seminars, and consult experts regularly. Furthermore, staying informed about economic trends helps them make better financial decisions consistently.

Additionally, wealthy individuals surround themselves with financially successful people. Therefore, their network provides knowledge, opportunities, and accountability for financial goals. Moreover, learning from others’ experiences accelerates your own wealth-building journey significantly.

Meanwhile, the 1% invest in themselves before investing in markets. Subsequently, developing skills that increase earning potential provides the foundation for wealth. Furthermore, higher income creates more opportunities to manage your money and build lasting wealth.

Budgeting Strategies The Wealthy Use To Manage Your Money

Zero-Based Budgeting Approach

Generally speaking, wealthy people know exactly where every dollar goes through careful budgeting. Furthermore, zero-based budgeting assigns purpose to all income before spending begins. Therefore, this method ensures intentional money management rather than wondering where money went.

Moreover, the 1% track expenses meticulously to manage your money with precision. Subsequently, they review spending patterns regularly and eliminate wasteful expenses quickly. Additionally, automated tracking tools make this process simpler and more accurate than ever.

Consequently, wealthy individuals separate needs from wants clearly in their budgets. Furthermore, they prioritize essential expenses and savings before discretionary spending. Meanwhile, this discipline ensures financial goals receive funding before lifestyle inflation consumes income.

Living Below Your Means To Manage Your Money

Furthermore, surprisingly, many wealthy people live modestly compared to their income levels. Generally, they manage your money by avoiding lifestyle inflation as earnings increase. Therefore, the gap between income and expenses grows larger over time.

Additionally, the 1% drive older cars, live in reasonable homes, and avoid flashy displays. Subsequently, this approach frees money for investments that generate passive income streams. Moreover, appearing wealthy matters less than actually building wealth through smart management.

Meanwhile, wealthy individuals question every major purchase carefully before committing. Furthermore, they calculate opportunity costs, considering what investments that money could generate instead. Therefore, this thinking prevents impulsive spending that derails long-term financial plans.

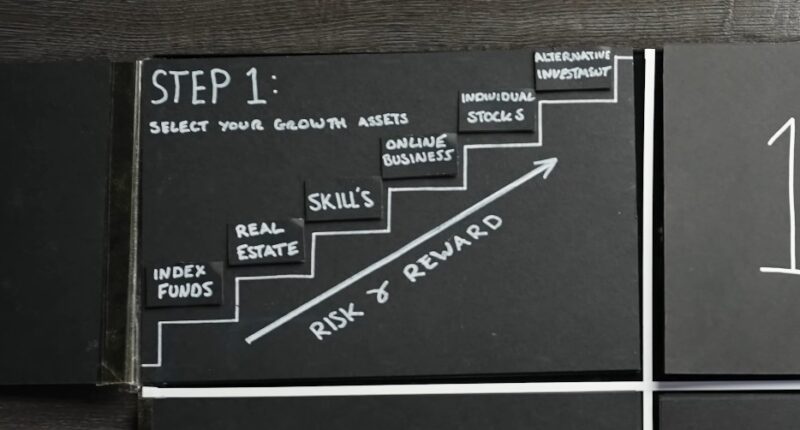

Investment Principles To Manage Your Money Like The Rich

Diversification Strategies

Initially, wealthy investors manage your money across multiple asset classes systematically. Generally speaking, they spread investments among stocks, bonds, real estate, and alternative assets. Furthermore, this diversification protects wealth during market downturns and economic uncertainty.

Moreover, the 1% invest globally rather than limiting themselves to domestic markets only. Subsequently, international exposure provides growth opportunities and additional diversification benefits. Additionally, emerging markets offer higher growth potential despite increased volatility.

Consequently, wealthy individuals rebalance portfolios regularly to maintain target allocations. Furthermore, this discipline forces selling high and buying low automatically over time. Meanwhile, rebalancing prevents overexposure to any single asset class or sector.

Passive Income Focus To Manage Your Money

Furthermore, the wealthy prioritize investments that generate ongoing passive income streams. Generally, dividend stocks, rental properties, and business ownership create money while sleeping. Therefore, passive income eventually replaces active employment income, creating true financial freedom.

Additionally, wealthy people manage your money by reinvesting passive income initially. Subsequently, this approach accelerates compound growth during wealth-building years. Moreover, only after reaching financial independence do they spend investment returns.

Meanwhile, multiple income streams provide security that single income sources cannot offer. Furthermore, the 1% typically have five to seven different income sources generating money. Therefore, losing one source doesn’t devastate their overall financial situation.

Tax-Efficient Investing To Manage Your Money

Moreover, wealthy individuals legally minimize taxes through strategic planning and timing. Generally speaking, they maximize contributions to tax-advantaged retirement accounts annually. Furthermore, these accounts allow investments to grow tax-deferred or completely tax-free.

Subsequently, the 1% understand how to manage your money across different account types. Additionally, they place tax-inefficient investments in retirement accounts and efficient ones in taxable accounts. Meanwhile, this asset location strategy reduces overall tax burden significantly.

Consequently, wealthy investors hold investments long-term to qualify for lower capital gains rates. Furthermore, harvesting tax losses offsets gains and reduces taxable income strategically. Therefore, after-tax returns matter more than pre-tax returns for actual wealth building.

Debt Management: How The Wealthy Manage Your Money

Strategic Use of Leverage

Generally speaking, wealthy people use debt strategically rather than avoiding it entirely. Furthermore, they borrow at low rates to invest in appreciating assets generating higher returns. Therefore, this leverage amplifies wealth building when used responsibly.

Moreover, the 1% clearly distinguish between good debt and bad debt. Subsequently, mortgages on rental properties and business loans can be good debt. Additionally, credit card debt for consumption represents bad debt that destroys wealth quickly.

Meanwhile, wealthy individuals never borrow for depreciating assets or lifestyle expenses. Furthermore, they manage your money by paying cash for cars, vacations, and luxury items. Therefore, interest payments flow into their investments rather than out to creditors.

Eliminating Consumer Debt Quickly

Furthermore, before building wealth, successful people eliminate high-interest consumer debt completely. Generally, credit card balances charging 15-25% interest prevent any meaningful wealth accumulation. Therefore, debt elimination becomes the first priority for aspiring wealthy individuals.

Additionally, the 1% would never pay interest on previous consumption choices. Subsequently, they manage your money by living within means and avoiding consumer debt altogether. Moreover, this discipline preserves income for saving and investing instead.

Consequently, wealthy people maintain excellent credit scores for advantageous borrowing terms. Furthermore, high credit scores provide access to lower interest rates when leverage makes sense. Meanwhile, paying bills on time and maintaining low utilization ensures optimal credit profiles.

Real Estate Strategies To Manage Your Money

Property Investment Approaches

Initially, real estate represents a cornerstone of wealth for many in the 1%. Generally speaking, rental properties generate passive income while appreciating over time. Furthermore, tax advantages like depreciation reduce taxable income from real estate investments.

Moreover, wealthy investors manage your money through careful property selection and analysis. Subsequently, they calculate cap rates, cash-on-cash returns, and appreciation potential before purchasing. Additionally, location, condition, and rental demand determine investment property success rates.

Consequently, leverage amplifies returns in real estate when used prudently. Furthermore, mortgage payments build equity while tenants cover expenses and generate profits. Meanwhile, this approach allows controlling valuable assets with relatively small initial investments.

Primary Residence Decisions

Furthermore, the wealthy view primary residences differently than average homeowners. Generally, they manage your money by not overbuying homes that strain budgets. Therefore, housing costs remain reasonable percentages of income, freeing money for investments.

Additionally, wealthy people consider opportunity costs when purchasing expensive homes. Subsequently, equity tied in primary residences doesn’t generate income or compound growth. Moreover, renting sometimes makes more financial sense than buying in expensive markets.

Meanwhile, the 1% avoid emotional real estate decisions that damage finances. Furthermore, they calculate costs objectively rather than falling in love with properties. Therefore, real estate decisions align with overall financial plans and wealth goals.

Asset Protection Strategies To Manage Your Money

Insurance and Legal Structures

Generally speaking, wealthy individuals protect accumulated assets through proper insurance coverage. Furthermore, umbrella policies provide liability protection beyond standard home and auto coverage. Therefore, lawsuits and accidents don’t threaten wealth built over decades.

Moreover, the 1% use legal structures like trusts and LLCs to manage your money safely. Subsequently, these entities separate personal assets from business liabilities effectively. Additionally, proper titling and beneficiary designations ensure smooth wealth transfer.

Consequently, estate planning protects wealth for future generations systematically. Furthermore, wills, trusts, and powers of attorney prevent costly probate and family disputes. Meanwhile, working with estate attorneys ensures comprehensive protection plans.

Emergency Preparedness

Furthermore, wealthy people maintain substantial emergency reserves before investing aggressively. Generally, they manage your money by keeping six to twelve months of expenses accessible. Therefore, market downturns don’t force selling investments at unfavorable prices.

Additionally, multiple accounts at different institutions provide security and access. Subsequently, the 1% never face situations where frozen accounts create emergencies. Moreover, diversified banking relationships protect against institutional failures.

Meanwhile, liquid assets allow wealthy individuals to capitalize on opportunities quickly. Furthermore, market crashes become buying opportunities when cash reserves exist. Therefore, emergency funds serve dual purposes of protection and opportunistic investing.

Building Multiple Income Streams To Manage Your Money

Active Income Optimization

Initially, wealthy people maximize their primary earning potential strategically. Generally speaking, they negotiate salaries, seek promotions, and develop valuable skills continuously. Furthermore, higher active income provides more capital for investment and wealth building.

Moreover, the 1% manage your money by treating careers as businesses themselves. Subsequently, they invest in education, networking, and skill development regularly. Additionally, switching employers often increases income faster than internal promotions.

Consequently, side businesses complement employment income for accelerated wealth building. Furthermore, entrepreneurial ventures provide additional income and potential equity value. Meanwhile, skills developed in employment often translate to profitable side hustles.

Passive Income Development

Furthermore, wealthy individuals systematically build passive income sources over time. Generally, they manage your money toward eventually replacing active income entirely. Therefore, financial independence occurs when passive income exceeds living expenses.

Additionally, dividend portfolios provide reliable quarterly income payments indefinitely. Subsequently, real estate generates monthly rental income from properly managed properties. Moreover, business ownership creates profits without requiring daily involvement.

Meanwhile, intellectual property like books, courses, and patents generates royalty income. Furthermore, licensing ideas and creations provides ongoing payments from single efforts. Therefore, creating assets that pay repeatedly builds wealth efficiently.

Habits That Help Manage Your Money Successfully

Daily Financial Practices

Generally speaking, wealthy individuals review finances regularly as standard practice. Furthermore, they manage your money by checking accounts, tracking investments, and monitoring progress. Therefore, problems get identified and addressed quickly before becoming serious.

Moreover, the 1% automate savings and investments to ensure consistency. Subsequently, automatic transfers prevent money from being spent before saving occurs. Additionally, automation removes willpower requirements from financial success.

Consequently, wealthy people review major purchases after waiting periods. Furthermore, cooling-off periods prevent impulsive buying decisions that damage finances. Meanwhile, this simple habit saves thousands annually on unnecessary purchases.

Surrounding Yourself With Success

Furthermore, wealthy individuals choose their associations carefully and intentionally. Generally, they manage your money mindset by learning from successful mentors. Therefore, average income of closest friends often predicts personal income levels.

Additionally, the 1% hire professionals to handle specialized financial matters. Subsequently, accountants, attorneys, and advisors provide expertise beyond personal knowledge. Moreover, professional guidance prevents costly mistakes and identifies opportunities.

Meanwhile, wealthy people continuously seek knowledge through reading and learning. Furthermore, they consume financial content, attend events, and study successful investors. Therefore, ongoing education ensures strategies remain current and effective.

Teaching Future Generations To Manage Your Money

Financial Education for Children

Generally speaking, wealthy families teach children about money from early ages. Furthermore, they manage your money education by involving kids in financial discussions. Therefore, children develop healthy money attitudes before reaching adulthood.

Moreover, the 1% give children opportunities to earn, save, and invest money. Subsequently, practical experience teaches lessons that lectures alone cannot provide. Additionally, matching children’s savings encourages developing saving habits early.

Consequently, wealthy parents model responsible financial behavior consistently. Furthermore, children observe spending, saving, and investing decisions throughout childhood. Meanwhile, these observations shape lifetime money attitudes and behaviors.

Wealth Transfer Planning

Furthermore, the wealthy plan carefully for transferring wealth to heirs and causes. Generally, they manage your money with multi-generational perspectives in mind. Therefore, estate plans minimize taxes and maximize wealth passed to beneficiaries.

Additionally, teaching financial responsibility precedes giving money to heirs. Subsequently, unprepared heirs often squander inherited wealth within generations. Moreover, gradual wealth transfer allows learning while parents provide guidance.

Conclusion

In conclusion, learning to manage your money like the 1% requires adopting specific mindsets and habits. Furthermore, these strategies aren’t secrets but rather disciplined practices anyone can implement. Generally speaking, wealthy individuals simply make different choices consistently over long periods.

Moreover, the journey to manage your money successfully begins with small steps today. Subsequently, budgeting, saving, investing, and debt elimination create foundations for wealth. Therefore, implementing even one strategy immediately starts positive momentum forward.

Additionally, patience and persistence matter more than initial income levels. Meanwhile, compound growth rewards those who start early and stay consistent. Furthermore, your financial future depends on decisions and habits you choose today.

Ultimately, you can learn to manage your money like the wealthy regardless of starting point. Therefore, commit to financial education and disciplined money management starting now.

For more financial insights and wealth-building strategies, visit Digital New IT and explore additional resources at Mark Tilbury.