Personal Loan vs Credit Card: Which Is Better for You?

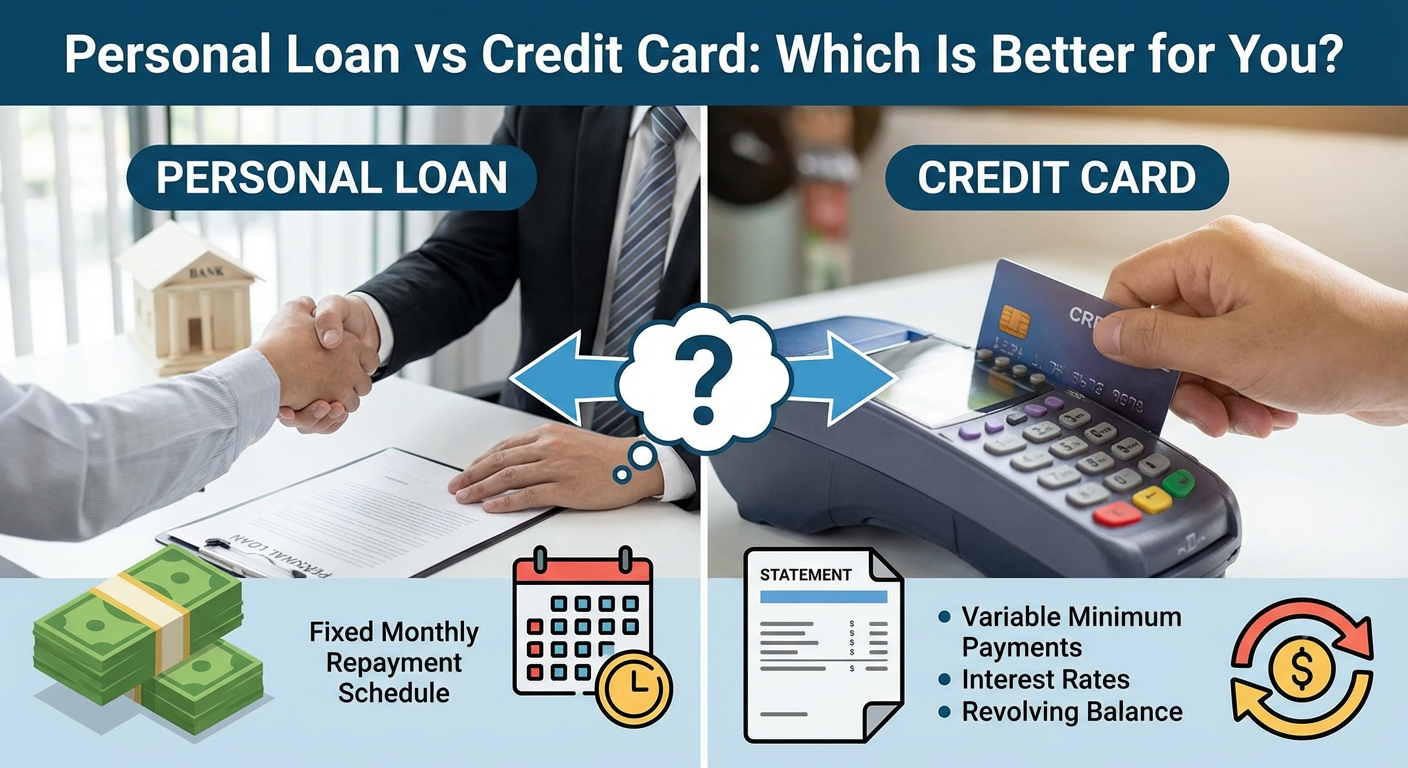

When you need money fast, you often face a common choice. Should you get a personal loan or use a credit card? Both options can help you cover expenses, but they work in very different ways. Understanding the difference between a personal loan vs credit card can save you money and stress in the long run.

In this guide, we will break down everything you need to know. By the end, you will have a clear picture of which option fits your needs best. So, let’s dive in and explore these two popular borrowing methods.

Understanding the Basics

Before we compare a personal loan vs credit card, let’s first understand what each one offers.

What Is a Personal Loan?

A personal loan is a fixed amount of money you borrow from a bank, credit union, or online lender. You receive the full amount at once and pay it back over a set period. This period usually ranges from one to seven years.

Moreover, personal loans come with fixed interest rates in most cases. This means your monthly payment stays the same throughout the loan term. As a result, budgeting becomes much easier because you know exactly what to expect each month.

What Is a Credit Card?

A credit card gives you access to a revolving line of credit. You can borrow money up to your credit limit whenever you need it. Additionally, you only pay interest on the amount you actually use.

However, credit cards often come with variable interest rates. This means your rate can go up or down over time. Furthermore, if you don’t pay your full balance each month, interest charges can add up quickly.

Key Differences Between Personal Loan vs Credit Card

Now that we understand the basics, let’s look at the main differences. These factors will help you decide which option works better for your situation.

Interest Rates

First and foremost, interest rates play a huge role in your decision. Personal loans typically offer lower interest rates than credit cards. In fact, the average personal loan rate is often 10% to 15% lower than credit card rates.

On the other hand, credit cards can charge rates of 20% or higher. Therefore, if you plan to carry a balance for a long time, a personal loan might save you significant money.

Payment Structure

Another important difference is how you make payments. With a personal loan, you get a fixed monthly payment. You know exactly when the loan will be paid off from the start.

In contrast, credit cards offer more flexibility. You can pay the minimum amount, the full balance, or anything in between. While this flexibility seems attractive, it can also lead to long-term debt if you only make minimum payments.

Access to Funds

When comparing personal loan vs credit card access, timing matters. Credit cards provide instant access to funds once approved. You can use your card right away for purchases.

Meanwhile, personal loans take longer to process. After approval, it may take a few days to receive your money. However, once you get the funds, you can use them for almost anything.

When Should You Choose a Personal Loan?

There are several situations where a personal loan makes more sense. Let’s explore these scenarios in detail.

Large Purchases or Expenses

If you need to cover a big expense, a personal loan often works better. For example, home improvements, medical bills, or major repairs can cost thousands of dollars. In these cases, the lower interest rate of a personal loan can save you money over time.

Furthermore, having a fixed payment schedule helps you plan your budget. You won’t be surprised by changing interest charges or varying monthly payments.

Debt Consolidation

Many people use personal loans to combine multiple debts into one. This strategy is called debt consolidation. By rolling high-interest credit card balances into a lower-rate personal loan, you can pay off debt faster.

Additionally, having just one monthly payment simplifies your financial life. Instead of tracking multiple due dates, you focus on a single payment each month.

Building Credit History

Taking out a personal loan and making on-time payments can boost your credit score. It adds variety to your credit mix, which credit bureaus view positively. Therefore, if you want to improve your credit profile, a personal loan can help.

When Should You Choose a Credit Card?

On the flip side, credit cards shine in certain situations. Here’s when they might be the better choice.

Small, Everyday Purchases

For smaller purchases and daily expenses, credit cards offer convenience. You don’t need to apply for a new loan each time you need money. Instead, you simply swipe your card and handle the payment later.

Moreover, many credit cards offer rewards programs. You can earn cash back, points, or miles on your purchases. These perks add extra value to your everyday spending.

Short-Term Borrowing

If you can pay off your balance quickly, a credit card works well. Many cards offer 0% introductory APR periods lasting 12 to 21 months. During this time, you won’t pay any interest on your purchases.

However, you must pay off the balance before the promotional period ends. Otherwise, high interest rates will kick in and increase your costs significantly.

Emergency Situations

Credit cards provide a safety net for unexpected expenses. Whether your car breaks down or you face a surprise bill, your card offers immediate access to funds. This quick access can be a lifesaver in true emergencies.

Factors to Consider When Choosing

Making the right choice between personal loan vs credit card depends on several factors. Consider these points carefully before deciding.

Your Credit Score

Your credit score affects the rates you’ll receive for both options. Generally speaking, better credit scores lead to lower interest rates. Therefore, check your credit report before applying for either option.

If your score is high, you’ll likely qualify for competitive rates on personal loans. Similarly, you may be eligible for credit cards with excellent rewards and low rates.

The Amount You Need

The size of your borrowing need matters greatly. For amounts under $1,000, a credit card usually makes more sense. The application process for a personal loan might not be worth it for smaller sums.

Conversely, for amounts over $5,000, personal loans often provide better value. The lower interest rates and structured payments help you manage larger debts more effectively.

Your Repayment Timeline

How quickly can you pay back the money? This question is crucial. If you can repay within a few months, a credit card with a 0% APR offer might cost you nothing in interest.

However, if you need more time to repay, a personal loan provides stability. You’ll know your exact payoff date from day one, which helps with financial planning.

Your Financial Discipline

Be honest with yourself about your spending habits. Credit cards require discipline because the available credit can tempt you to overspend. If you struggle with impulse purchases, a personal loan might be safer.

Since personal loans give you a lump sum, you won’t be tempted by ongoing credit availability. This structure can help prevent additional debt.

Pros and Cons Summary

To wrap up our comparison, here’s a quick overview of each option.

Personal Loan Advantages

Personal loans offer lower interest rates for qualified borrowers. They provide predictable monthly payments and fixed repayment terms. Additionally, they work well for larger expenses and debt consolidation.

Personal Loan Disadvantages

On the downside, personal loans may have origination fees. They also require a formal application process that takes time. Once you borrow, you cannot access additional funds without applying again.

Credit Card Advantages

Credit cards provide flexibility and instant access to funds. Many offer rewards and 0% introductory rates. They also work well for building credit when used responsibly.

Credit Card Disadvantages

However, credit cards often carry higher interest rates. They can lead to ongoing debt if mismanaged. Variable rates may also increase your costs unexpectedly.

Making Your Final Decision

Choosing between a personal loan vs credit card comes down to your unique situation. Consider your financial goals, borrowing needs, and repayment ability carefully.

If you need a large sum and want predictable payments, lean toward a personal loan. If you need flexibility and can pay off balances quickly, a credit card might serve you better.

Remember, both options can help you achieve your financial goals when used wisely. The key is understanding how each works and choosing the one that fits your needs.

Conclusion

In the debate of personal loan vs credit card, there’s no one-size-fits-all answer. Both financial tools have their place in your money management toolkit. By considering the factors we’ve discussed, you can make an informed decision that supports your financial health.

Take time to compare rates, terms, and your personal circumstances. With the right choice, you’ll be on your way to managing your finances more effectively.

References:

For more helpful guides on finance and technology, visit Digital New IT.

For convenient link management tools, check out URL Shorter.